A life insurance policy can be a significant relief after a family loses a loved one. It can help keep them financially stable and enable them to address any unfulfilled financial obligations. However, many British Columbians receive denials after filing life insurance claims, leading to added heartache and potential hardships.

A denied life insurance payout is more than just stressful. It can also have real financial consequences for family members. Getting advice from an experienced life insurance lawyer can help get your claim on the right track.

The Most Common Reasons For Life Insurance Denials

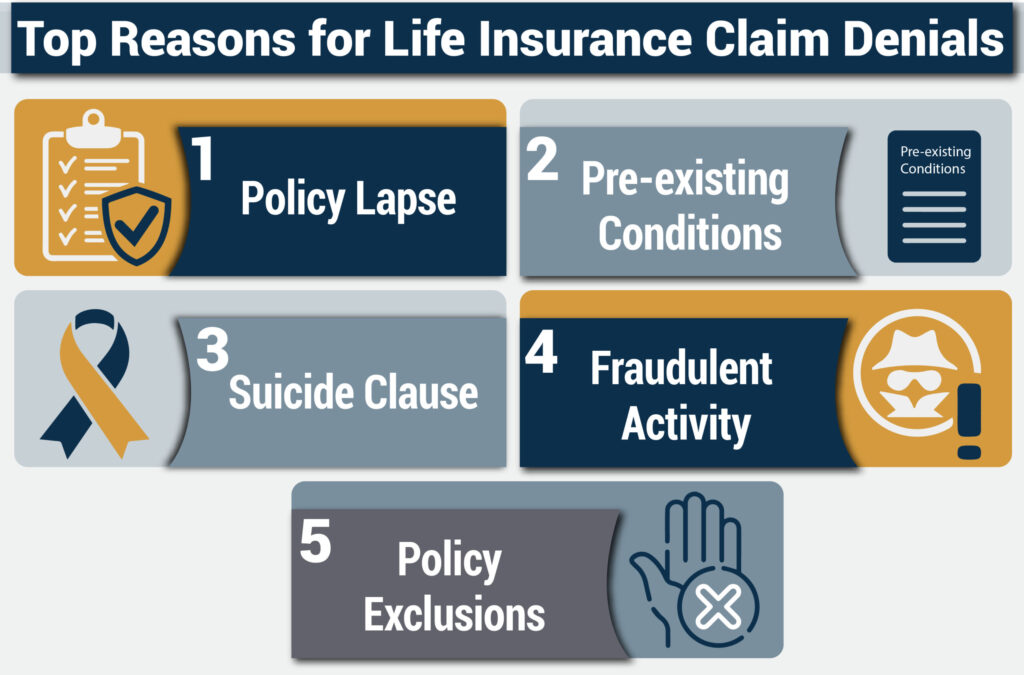

Here are the most common reasons life insurance companies in British Columbia may deny claims:

- Policy exclusions – Most life insurance policies contain exclusions for certain causes of death. If the insured’s death resulted from something that was excluded, such as suicide within the first two years, the claim might be denied.

- Lapsed payments – Policyholders must keep life insurance policies current with premium payments to remain in effect. If the policy lapsed due to nonpayment, the insurance company can deny a claim even if the holder had made regular payments for years prior.

- Fraudulent information – Life insurance applications require disclosing all relevant medical and lifestyle information. Providing false, incomplete, or misleading information can allow the insurance company to deny a claim due to fraud.

What Is the Impact of a Denial on Estates?

A life insurance claim denial can have a ripple effect on the deceased’s estate and beneficiaries, including:

- Financial instability – Beneficiaries who depend on the life insurance proceeds to cover expenses like funeral costs, medical bills, and ongoing living expenses can experience significant financial hardship without the expected payout.

- Legal hurdles – The estate may need to go through lengthy legal battles with the insurance company to fight the denial.

- Delay in settling the estate – Distributing assets to beneficiaries may be put on hold while a denied claim gets resolved, dragging out the estate settlement process.

How to Commence a Claim After Denial

If your life insurance claim has been denied, you should:

- Review the denial letter – Look closely at the specific reasons for the denial. This language will provide direction on how to appeal.

- Gather supporting documents – Compile medical records, physician statements, and any evidence you have to refute the denial.

- Consult a life insurance lawyer – An experienced life insurance appeals lawyer can evaluate the merits of your appeal and represent your interests.

- File an appeal – Your legal representative can draft an appeal letter disputing the denial, including all relevant documentation necessary to substantiate your claim.

Contact an Experienced Life Insurance Lawyer in Vancouver, British Columbia

Losing a loved one is never easy, and the added stress of a life insurance claim denial can make the pain feel even worse. However, a denial does not need to be the end of the story. Working with a knowledgeable and skilled life insurance lawyer in Vancouver can help you understand your options and appeal your claim. Contact Warnett Hallen LLP today for a free consultation.